ABOUT

LAVASTONE

OUR FOUNDATIONS SHAPE TOMORROW

ABOUT

LAVASTONE

OUR FOUNDATIONS SHAPE TOMORROW

Our Mission

Partnering with our stakeholders to deliver superior value in design, quality, sustainability and services.

Our Vision

To be the preferred partner for commercial real estate solutions, while delivering optimum return to our shareholders.

Our Values

Agility

We seek to unleash our capacity to quickly and best understand opportunities and threats so we can adapt accordingly, choosing the most appropriate course of action and energetically implementing it.

Humility

We understand we are not perfect and aim to learn from others through each encounter, in order to keep improving.

Care

We foster a family spirit built on integrity to encourage sustainable communities.

Passion

We constantly push beyond our limits, challenging the status quo with innovative solutions.

Our Milestones

- December 2018: Listing of Lavastone Ltd on the Development & Enterprise Market (DEM)

- December 2018: Acquisition of Compagnie Valome Ltd (CVL/Owner of C Rodrigues Mourouk)

- December 2019: Opening of EDITH in Port Louis

- June 2020: Integration of Lochiel Property Services Ltd (now Lavastone Services Ltd) to Lavastone Ltd

- October 2021: Opening of Sunrise Attitude

- June 2022: Acquisition of Absa House

- December 2019: Opening of EDITH in Port Louis

- July 2022: Inauguration of Victoria Urban Terminal

- November 2022: LEED Gold Certification of EDITH

- November 2023: Opening of C Rodrigues Mourouk

- November 2023: Acquisition of SOFAP Buildings

- April 2024: Acquisition of Integrity Building at Riche Terre

- June 2025: Sale of Trianon Land

Board of Directors

Colin Taylor

Non-Executive Director and Chairman

Appointed in 2015

Colin holds an MSc in Management from Imperial College, London, and a BSc (Hons) in Engineering with Business Studies from Portsmouth Polytechnic. He is the Chairman and CEO of Taylor Smith Investment Ltd, a diversified group of companies operating in marine services, logistics, cement importation, manufacturing, and property.

He also serves on the boards of several private companies, bringing with him a strong understanding of multiple sectors.

Expertise: Leadership, corporate governance, business strategy, and diversified group management.

Directorship in other listed companies:

CIM Financial Services Ltd

Gaetan Ah Kang

Non-Executive Director

Appointed in 2018

Gaetan spent the first six years of his career working in an audit firm in the UK, before returning to Mauritius in 1992 to join De Chazal Du Mée in an audit role. He subsequently moved to the Risk and Audit Team of the Rogers Group in 1994, before becoming the Finance Manager of the Rogers Group’s Engineering Cluster in 1999. In 2004, Gaetan was appointed Group Finance Director of the Taylor Smith Group, as well as a member of the Audit and Risk Committee. In 2021, he headed the financial aspect and due diligence process of the TSI Group’s acquisition of Lafarge Holcim Indian Ocean, now known as Cementis. Gaetan is a member of the Institute of Chartered Accountants in England and Wales (ICAEW).

Expertise: Finance, audit, risk management, due diligence and corporate finance.

Directorship in other listed companies: None

Ann Charlotte Vallet

Non-Executive Director

Appointed in 2022

Ann Charlotte Vallet is the Founder, Chairperson and Manager of the Taylor Smith Foundation, an entity created in 2010 through the Taylor Smith Group with a mission to contribute to sustainable development through economic, social, and environmental pillars.

The Foundation promotes numerous initiatives in the fields of education and youth development, the empowerment of women and families, sports, and the protection of the environment.

Expertise: Corporate social responsibility, sustainable development, community engagement, and social impact strategy.

Directorship in other listed companies: None

Nicolas Vaudin

Executive Director and Managing Director

Appointed in 2017

Nicolas holds an MBA from Surrey European Management School, University of Surrey (Guildford, UK), and a Bachelor of Applied Science in Hospitality Administration from Southern New Hampshire University (Manchester, USA). In February 2017, he joined Cim Group as the Managing Director for the Cim Property cluster. He played a significant role in the rebranding and restructuring of the cluster, which led to the listing of Lavastone Ltd on the DEM in December 2018. Following this, Nicolas was appointed as the Managing Director of the Lavastone Group. Prior to his tenure with Cim Group, Nicolas amassed significant experience in real estate. He spent over six years at Ciel Properties Ltd, where he played a pivotal role in the development of Anahita. Thereafter, he spent another six years at PricewaterhouseCoopers Ltd, leading the real estate advisory practice.

Expertise: Real estate development, property management, corporate strategy, business restructuring.

Directorship in other listed companies: None

Philip Simon Taylor

Non-Executive Director

Appointed in 2022

After obtaining a BSC in Hotel Management at the University of Surrey (England) in 1989 and an MBA in Corporate Finance in 1994 also at the University of Surrey, Philip relocated to Mauritius and assumed a leadership role in the international development division of the Rogers Group. In 2010, Philip established his own business development advisory firm, which undertakes diverse projects across property development, energy, logistics, financial services, hospitality, and tourism. Currently, Philip is at the helm of an innovative hospitality digital services and travel & tourism intelligence company entitled www. hospitality-plus.travel. In addition to his Directorship at Lavastone Ltd and several non-listed companies, he is a Non-Executive Director on the Board of CIM Financial Services Ltd, where he is a member of the Corporate Governance and Conduct Review Committee. Philip is also the Honorary Consul of Finland in Mauritius.

Expertise: Hospitality & tourism, corporate finance, business development, corporate governance

Directorship in other listed companies: CIM Financial Services Ltd

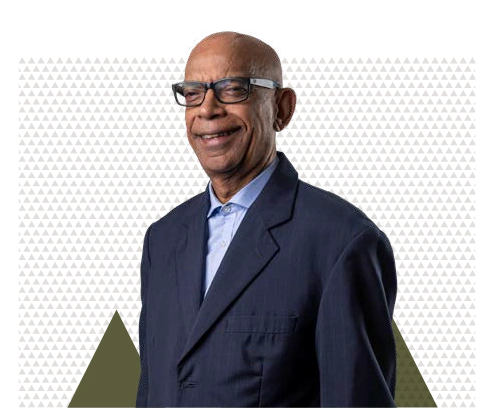

Jose Arunasalom

Independent Director

Appointed in 2018

Jose holds a Bachelor’s degree in Economics and a Master’s degree in International Relations. He has held various senior executive positions within the private sector in Mauritius, after which he filled significant governmental roles over a remarkable 23-year period, including a tenure as Minister of Tourism. Jose’s expertise extends beyond his domestic involvement, serving as a Director on the Board of two equity funds, and having advised governments in Madagascar and Africa. Additionally, he has been elected as a Member of the National Assembly for five consecutive terms.

Jose is the Economic Adviser of the Rodrigues Regional Assembly and a fellow member of the Mauritius Institute of Directors. More recently, in January 2025, he was appointed as the Chairman of the Tourism Authority.

Expertise: Public sector governance, tourism policy, economic advisory

Directorship in other listed companies: None

Vijaya Lakshmi Anna (Ruby) Saha

Independent Director

Appointed in 2018

Ruby is a barrister who joined the Bar as a second career in 2007. A former Government Laureate from Loreto Convent Port Louis, she studied Geography and Town Planning at the University of Wales, and began her professional career in the United Kingdom as a technical expert.

Upon her return to Mauritius, Ruby joined the Ministry of Housing and Lands, ultimately retiring as Chief Technical Officer. During her tenure, she contributed to a wide range of projects, including low-income housing, public beach identification, climate change and cyclone emergency programmes, road re-routing, spatial planning in Rodrigues, and joint public-private coastal planning initiatives.

Since joining the Bar, Ruby has continued her commitment to the built environment, representing clients before all Courts of Mauritius in matters relating to planning and environmental law. Her interest lies in defending built-up areas against substandard developments and advocating for fair compensation in cases of compulsory acquisition. Ruby remains passionate about contributing to sustainable development in Mauritius and promoting greater social justice.

Expertise: Urban planning, environmental law, public policy, and sustainable development

Directorship in other listed companies: None

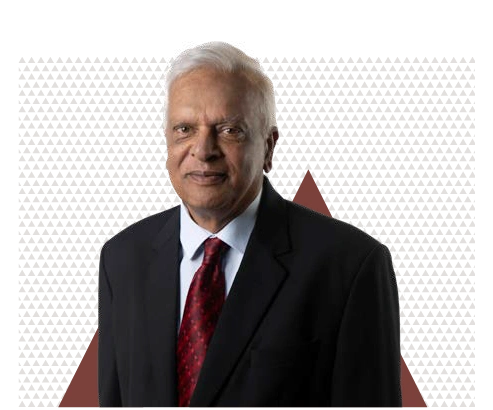

Vedanand Singh (Shyam) Mohadeb

Independent Director

Appointed in 2018

Shyam, Chartered Accountant and former Senior Assurance Partner at PWC (Mauritius), is a financial consultant specialising in the financial and realty sectors. He qualified as a Chartered Accountant in Belfast, Northern Ireland, with the local representative of Touche Ross.

Upon his return to Mauritius, he joined Kemp Chatteris as an audit senior, until he was made a partner in January 1985. He managed a varied audit portfolio of companies operating in the banking, sugar, manufacturing and commercial sectors, enabling him to garner deep industry knowledge.

In 1987, Shyam left Kemp Chatteris to form Price Waterhouse, alongside other founder partners. Between 1988 and his retirement as a senior assurance partner, he continued to serve several companies in different sectors of the economy, including acting as a financial advisor to two major textile companies and helping to turn them around. During his tenure at PwC, and also at Kemp Chatteris, he carried out several insolvency assignments.

Since July 2015, Shyam has been serving as an Independent Director and financial consultant serving the reality and financial sectors.

Expertise: Financial reporting, audit, corporate governance, and business turnaround strategies.

Directorship in other listed companies: None

Profile of key Senior Officers and Executives

Jessica Sumputh

Human Resource Manager

Jessica is a qualified HR professional with 11 years of extensive experience across the hospitality, manufacturing, services, and real estate sectors. She earned her Diploma in Management, with a specialisation in Human Resource Management, from the University of Mauritius in 2014. She also holds a Master’s Certification in Neuro-Linguistic Programming, and is a Certified Enneagram Practitioner and an ICI Associate Coach, offering a synergistic and holistic approach to personal and professional development.

Employed by the Taylor Smith Group, Jessica has been serving as the outsourced HR and People Development Manager at Lavastone Properties since October 2020. She provides hands-on HR solutions, bringing her strong problem-solving capabilities, coaching skills, and empathetic nature to create a positive work environment at Lavastone Properties, where employees feel supported, empowered, and equipped to thrive in their roles.

Alex Lan Pak Kee

Head of Finance

Alex holds a BA (Hons) in Accounting and Finance from the University of Manchester. He joined Lavastone Properties as Finance Manager in 2020 and subsequently became the Financial Controller of the Group in October 2021. Alex was promoted to Head of Finance in 2024.

Before joining Lavastone Properties, he worked as an Accountant in Medine Limited’s Property cluster, and previously, as a Senior Associate in PwC Mauritius’s assurance department, where he led external audit assignments across various sectors including property, hospitality, textile, life insurance, and petroleum.

Alex is a member of the Institute of Chartered Accountants of England & Wales (ICAEW).

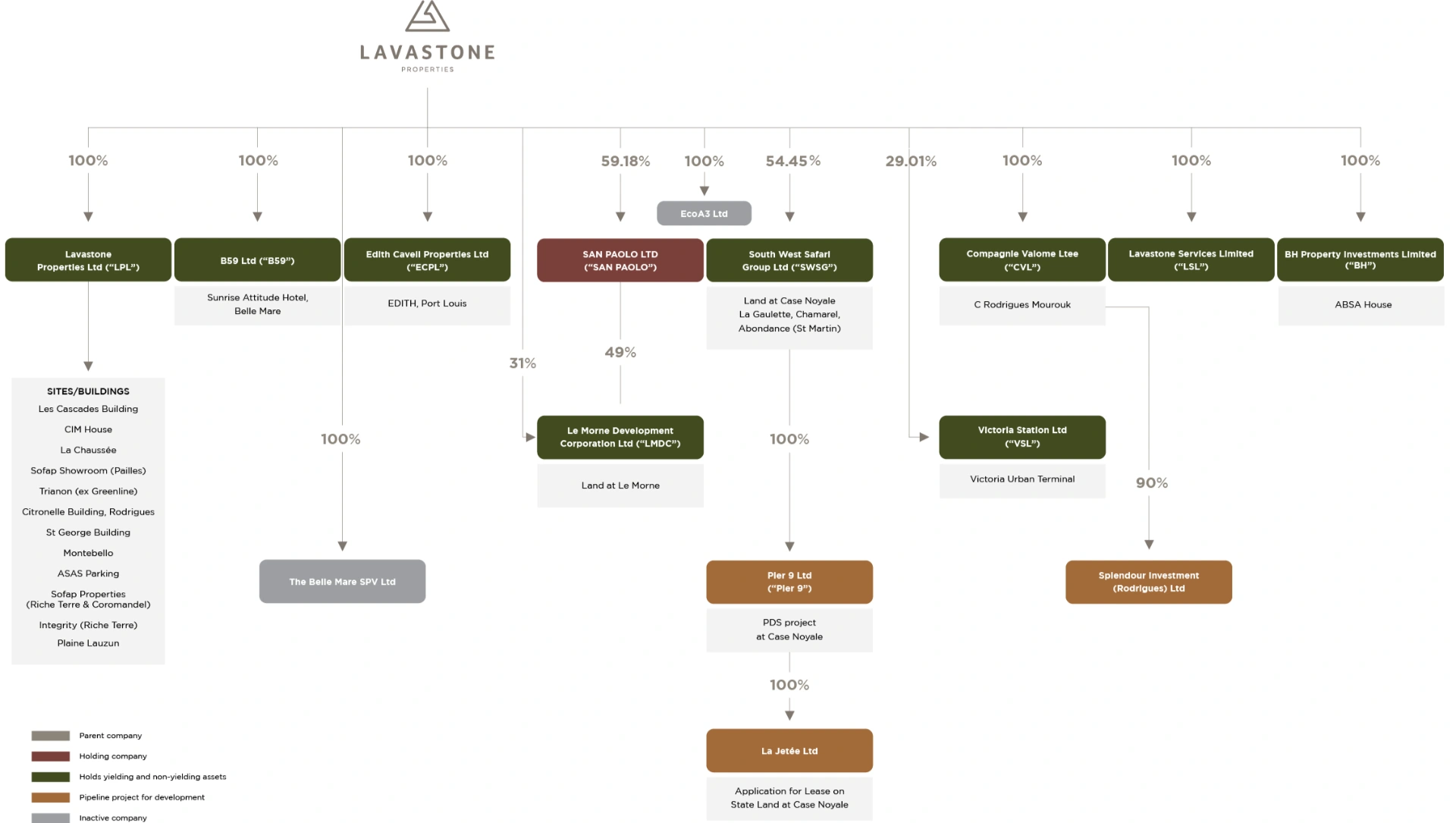

Our organisational structure

as at 30 September 2025

Our Activities

Property Investment & Development

We allocate capital towards the acquisition and development of new properties and the redevelopment of existing assets to attract quality tenants, participate in growing our existing tenants’ businesses, and deliver good returns to our shareholders. To achieve this, we develop modern, sustainable and enriching properties to increase their yielding value.

Property Management

Through Lavastone Services Ltd, we diligently evaluate and respond to our tenants’ changing needs with respect to their day-to-day operations, security, maintenance, repairs and general upkeep. To facilitate this, and to become more energy-efficient, we invest in smart technologies across all our properties.

Portfolio Management

We actively manage our existing properties, whilst also investigating new acquisition opportunities that enable us to strengthen and diversify our portfolio. We regularly perform building surveys and asset reports to identify assets we can dispose of, using the capital to invest in sites with higher long-term yields and capital growth prospects.

AT A GLANCE

Floor space available for rental

Weighted average lease expiry (WALE)

HIGHLIGHTS

Financial Highlights (Rs)

Operating profit

excluding sale of Land

Earnings per share

Profit Before Tax (PBT)

less other gains and losses

Net assets

Dividend per share

Non-financial highlights

as at 30 September 2025

Office space | 22,230m²

Industrial space | 15,069m²

Office space | 4,798m²

Hotel | 11,544m²

Arpents of bare land | 1,374A

Projects under

development (GLA) | 9,210m²