PRECISION PLAY

PERFORMANCE

REPORT

Paving the way,

one move at a time

MANAGING DIRECTOR’S

INTERVIEW

Dear Stakeholders,

Considering the challenging market conditions that prevailed throughout the year, FY 2023 was a satisfactory year for Lavastone Properties. Turnover for ongoing operations increased by a commendable 6.4% and operating profit by 4.3%, driven mainly by the rental income derived from Absa House and the onboarding of quality tenants at EDITH. In spite of escalating finance costs and increases in administrative costs, we acquired quality tenants, improved our occupancy rate to 97%, and maintained a low gearing level, indicating Lavastone’s resilient financial and operational standing.

Opening gambit: making the right move, at the right time

In last year’s report, I forewarned of high interest rates and their potential impact on Lavastone Properties’ finance costs. True to these expectations, 2023 unfolded as a challenging year, with interest rates undergoing successive hikes during the first quarter of FY 2023, in a quest to stabilise inflation. The nature of our business requires the use of a mix of equity and borrowings to finance our development projects and future acquisitions, which invariably exposes us to volatility in interest rates. This translated into an additional Rs 26.9m in finance costs in FY 2023 compared to the previous year.

Anticipating a prolonged period of high interest rates, we renegotiated an extension to our bond terms with the Mauritius Commercial Bank (MCB) and made the decision to draw down the final Rs 550m available to us at a fixed interest rate, despite not having an immediate avenue for the funds. While part of the funds were promptly allocated to finance the Mourouk hotel, the surplus was temporarily placed in shortterm deposits to cover our interest costs, before being deployed towards acquisitive opportunities that are expected to generate additional profit during FY 2024.

Streamlining our moves: operational highlights

The cyclical nature of the industry requires a property investment company to continuously adjust its strategy and remain nimble in the face of changing circumstances. In pursuit of a high-yielding portfolio, adaptability is key: we carefully reevaluate our projects and acquisitions, retract decisions that no longer hold our strategic interest, and shift our focus to more advantageous positions. During the year, our efforts were centred on diversifying our portfolio, optimising the yielding potential of our properties and achieving operational excellence:

• Recognising our exposure to the office segment following the sale of our warehouses in Riche Terre, we recently completed the negotiations for the acquisition of fully tenanted industrial properties. We have sufficient capital, through the bond drawdown, to deploy towards these yielding investments and we expect this to result result in a more balanced portfolio in terms of asset class.

• As expected, the acquisition of Absa House has solidified our presence both in a new geography, Ébène, and in the office segment. Following the refurbishment of two vacant floors in the building to attract high-calibre tenants, we were pleased to see that both floors found new occupants, which is extremely encouraging for us given the acute competition in the office segment in Ébène, and the high expectations of tenants when it comes to their office environment.

• We onboarded new tenants at EDITH, which is now home to local retail stores, well-known F&B brands and House of Digital Art, a contemporary cultural venue dedicated to the digital arts. Our efforts to upgrade the retail, dining and entertainment experience at EDITH have delivered an increase in footfall and trading density. In my view, our historic city centre is every bit as vibrant as other business hubs on the island, particularly with the added accessibility and convenience brought by the Metro Express. Port Louis has much to offer in terms of cultural events, artworks, leisure leisure spaces, and an eclectic mix of dining options. Effective communiation on these strengths, coupled with close collaboration among all players in the capital, is paramount for repositioning our capital as the place to be.

• All our properties were tenanted during the year, achieving an average 97% occupancy rate. Equally, 28 contracts were renewed and our rental collections stood at 98%. These metrics attest to the quality of our assets, the strong relationships we have built with our tenants, and our continuous investments in operational excellence and customer retention strategies.

• The opening of the Mourouk hotel was delayed by a few months due to logistical and labour challenges, which are to be expected when operating in a remote location such as Rodrigues. (More information in our case study on page 50). However, at the time of writing this message, the resort successfully opened its doors on 01 November 2023. The hotel’s ideal location in one of the world’s premier kitesurfing spots, its strong value proposition rooted in authenticity and sustainability, and our collaboration with a trusted and experienced hotel operator position the hotel for a promising performance.

• Our land conversion plans are on track, with 100% of the plots at Case Noyale already transferred at the time of writing, enabling us to recognise Rs 36.5m for the sale of land in FY 2023. A masterplan was finalised for the sustainable development of the remaining land, echoing our commitment to environmental stewardship.

Checkmate for impact: Environmental and social performance

Decarbonisation stands as one of Lavastone Properties’ foremost priorities for achieving more financially and environmentally sustainable operations, two concepts we view as inseparable. This past year, we partnered with WillChange to go further in establishing a strategy to reduce our carbon footprint by tackling Scope 3 emissions. Due to the complexity and volume of data required for this endeavour, its success hinges on the full commitment and active involvement of our tenants. We are thrilled at their positive response and sincere enthusiasm to participate in our environmental-driven and community-driven actions.

Building on EDITH’s LEED Gold certification in 2022, a groundbreaking recognition as the first mixed-use building of its kind in Africa, we are now engaging closely with other tenants in pursuit of the LEED certification for other key assets. A gap analysis was carried out within key buildings to take stock of their current energy and sustainability performance, and a clear roadmap has been outlined towards attaining the desired LEED certification with the collaboration of our tenants.

Game of talent: Valorising Lavastone Properties’ employees

Our employees form the bedrock of our organisation. It is therefore important that we offer a work environment that values, rewards and empowers them. To achieve this, we facilitate opportunities for formal and informal discussions, providing constructive feedback through various channels to ensure we remain fully attuned to their needs.

We also invest a considerable amount in training our staff in technical and soft skills to equip them with the competencies they need to excel in their roles and contribute to our long-term objectives. In FY 2023, we expanded our training initiatives to also include sessions on the calculation of our carbon footprint. This not only enhances our employees’ knowledge of the subject, obtaining their buy-in for our environmental goals, but also helps us build a dynamic and skilled team dedicated to sustainability and innovation.

Endgame strategy: Closing remarks and appreciation

As Lavastone Properties embarks on a new financial year, we do so equipped with a strong tenant pipeline, good liquidity, a well-balanced portfolio and the right teams in place to drive our growth plans. Our immediate priority is to deliver on the following strategic imperatives:

• Close on the acquisitions in the warehousing/industrial building space and seek out quality tenants to fill the vacant spaces across our portfolio.

• Continue to renovate and fit out our tenanted spaces in line with their business needs.

• Launch the construction of a new commercial development in Case Noyale, contingent upon securing the necessary approvals and permits.

• Pursue digitalisation and process improvements to generate more efficiencies, maintain high occupancy rates and customer satisfaction levels, and unlock the full yielding potential of our properties.

• Pursue the LEED certifications for other key assets with the collaboration of our tenants and make measurable progress in our carbon-reduction plans.

• Explore innovative ways to leverage our expertise in asset management, property management and facilities management, designed to diversify our revenue sources and lower our finance costs.

I would like to end my message by bidding farewell and extending a heartfelt thank you to our longstanding team member, François Audibert, who is parting with the Group after 13 years of service. François was responsible for the day-to-day operations of Lavastone Properties and led several development projects that have contributed enormously to our growth over the last five years. François is now ripe to take on new challenges as the Head of Aqualia. On behalf of the entire Lavastone Properties family, I would like to thank him for his dedication and efforts, and convey our best wishes for a prosperous career ahead.

With François’ departure, a window of opportunity for organic growth and career advancement has opened up for colleagues who have been diligently prepared to step into more significant roles. We strongly advocate for internal mobility as a means to promote talent from within and build a more skilled team.

Thank you to all our stakeholders – our shareholders, tenants, partners, suppliers, contractors, consultants and customers – who continue to place their trust in Lavastone Properties.

I would also like to express my gratitude to our Board members for their valuable insights and counsel, and to our Chairman, Colin Taylor, for his unwavering guidance and support.

Nicolas Vaudin

Managing Director

PERFORMANCE

REVIEW

FINANCIAL CAPITAL

We carefully consider our investment decisions and employ our financial resources with discipline to enhance our revenue generation opportunities, while maximising shareholder returns

OUR KEY INPUTS

-

Rs 550m Final drawdown of bond facility from Rs 900m, intended to finance development projects and future acquisitions - Negotiations for three acquisitions in the pipeline

PERFORMANCE HIGHLIGHTS

- Concluded negotiations of acquisitive opportunities intended to rebalance our asset portfolio

-

Leased out vacant floors at Absa House following extensive refurbishments, to reach

92% occupancy at September 2023 and full occupancy by second quarter of FY 2024 - Secured three new contracts to provide Facility Management and Property Management services to third parties

2024 PRIORITIES

-

Continue improving rental collection to above

98% - Monitor and mitigate finance costs in light of high interest rates

-

Monitor and control administrative and operating costs to remain at

40% of revenue -

Achieve revenue growth of more than

15% -

Close on the acquisitive opportunities by the end of

Q2 FY 2024

OUTPUTS AND VALUE CREATED

-

Rs 1,089M Market Capitalisation -

Rs 306M Revenue (excluding sale of land) -

Rs 152M Profit before tax (excluding revaluation gains) -

Rs 4.18 NAV per share -

33% Gearing ratio -

Rs 0.07 Dividends paid per share -

Rs 0.32 Profit per share -

98% Rental collection (includes collection of rental arrears) -

91% Deeds of Sale completed for Morcellement Acacia in LaGaulette (100% by December 2023)

Strategic objectives

Operational excellence

Customer service and retention

Sustainability

Maximise shareholder value

Employee engagement

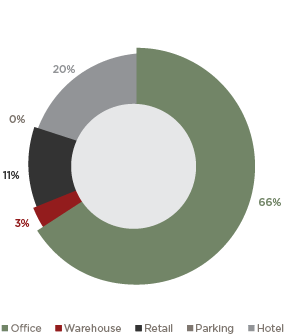

MANUFACTURED CAPITAL

We have a diversified portfolio of commercial properties across Mauritius and Rodrigues. Our goal is to continuously optimise our portfolio across asset classes and geographies to maximise our returns and balance our risks

OUR KEY INPUTS

-

21,532 m2 office space -

7,969 m2 industrial space -

4,655 m2 retail space -

6,714 m2 hotel space -

4,830 m2 project under development in Rodrigues for the Mourouk hotel

PERFORMANCE HIGHLIGHTS

- Finalised masterplan for South West Safari Group

- Submitted Environmental Impact Assessment (EIA) for the next morcellement at Case Noyale

- Obtained clearance from the Ministry of Agriculture, along with the Outline Planning Permit, for the masterplan at La Gaulette/Case Noyale

- Replaced the AC system on fifth floor of Absa House with a more efficient mini Variable Refrigerant Volume (VRV) system, designed to match a building’s precise requirements

- Completed the revamping of EDITH terraces

- Renovated and leased the 6th floor of Absa House

- Completed 80% of the refurbishment of the 5th floor at Absa House, targeting completion at the end of December 2023

- Tenant fit-out coordination for 11 tenants at EDITH

- Resolved Montebello water issue by implementing a new water network

- Transformed La Galerie du Génie at EDITH into an immersive art experience with House of Digital Art

2024 PRIORITIES

-

Obtain necessary permits to launch the next projects at Case Noyale (morcellement and commercial) - Open PLAY Mourouk Hotel by November 2023

- Renovate ground floor at Les Cascades Building to accommodate new tenants

- Refurbish 5th floor of Absa House by Q1 FY 2024

OUTPUTS AND VALUE CREATED

-

Rs 4.1Bn Property Assets -

Rs 4.9Bn Total Assets -

97% Average occupancy rate across all properties

Strategic objectives

Operational excellence

Customer service and retention

Sustainability

Maximise shareholder value

Employee engagement

INTELLECTUAL CAPITAL

We invest in the latest technologies, new systems, and future-proof capabilities to meet our customers’ needs and enhance the efficiency of our operations

OUR KEY INPUTS

- Investment in automatic billing system

- Monthly data collection at EDITH

- Identification, negotiations, and due diligence for acquisitive opportunities

- Treasury management

PERFORMANCE HIGHLIGHTS

- Implemented an automatic billing platform (Skybill)

-

Reduced utilities consumption across all properties - Used Artificial Intelligence (AI) for Business Process and Facility & Building Management

-

Maintained Grade A credit rating from CARE Ratings Africa - Maintained LEED certification at EDITH

- Identified & completed negotiations

2024 PRIORITIES

-

Improve profitability by at least 5 % through operational excellence - Maintain Grade A rating from CARE Ratings Africa

- Automate Procure to Pay process

- Reduce vacancy rate across the portfolio

-

Initiate LEED certification at other key property assets - Implement a Facility & Asset Management software

-

Maintain client retention rate at

above 95% - Manage the development of new warehouse for Rotoby Properties at Riche Terre for completion by Q3 FY 2024

OUTPUTS AND VALUE CREATED

-

6.71 years Weighted Average Lease Expiry (WALE) -

Grade A stable rating from CARE Ratings Africa reaffirmed for MCB Bond andCARE rating A- for Absa loan reaffirmed -

87 clients retained (out of 137) -

22 new tenants onboarded over2,513 m2 of space across the portfolio -

3% Vacancy rate

Strategic objectives

Operational excellence

Customer service and retention

Sustainability

Maximise shareholder value

Employee engagement

NATURAL CAPITAL

We are committed to reducing our carbon footprint through the judicious use of natural resources, energy-efficient systems and measures, and circular economy solutions, all aimed at mitigating the effects of climate change

OUR KEY INPUTS

-

1,374 Arpents of bare land with approximately50 arpents at Case Noyale available for development opportunities - Ongoing partnerships with NGOs for recycling and waste management

- Development of our assets in line with LEED principles

PERFORMANCE HIGHLIGHTS

-

Appointed WillChange for the

calculation of Lavastone Properties’ carbon footprint and for assistance with the development of acarbon-reduction strategy that aligns with the Group’s overarching strategy -

Completed the

installation of PV-powered chargers for electric vehicles at ASAS Parking -

Pursued

waste recycling processes, leading to the production and distribution of pencils made from recycled annual reports - Exploring PV potential for our assets

- Reused construction materials for refurbishment projects intelligently

2024 PRIORITIES

-

Refine Scope 3 investigations and reduction, namely employee commuting, waste management, and upstream and downstream emissions - Audit in-house assessment of carbon footprint by an independent third party

-

Increase

PV usage across the portfolio - Initiate LEED certification at other key property assets

-

Maintain utilities performance and

reduce consumption by at least 2% in KwH across portfolio -

Embark on an

endemic tree-planting programme at Bertrand Estate in the South of Mauritius

OUTPUTS AND VALUE CREATED

-

10% Reduction in water expenses on ECPL and15% on LPL -

217 kg glass collected -

3,195 kg cardboard collected -

29.4 kg plastic polystyrene collected -

11,094 kg food waste recycled with BIO Bins, which were converted into four cubic metres of compost -

174 Kg paper recycled through annual reports, converted into 8,426 pencils, including some plantable pencils -

4% reduction in kVA demand at EDITH -

16% reduction in average KwH consumption at Les Cascades Building

Strategic objectives

Operational excellence

Customer service and retention

Sustainability

Maximise shareholder value

Employee engagement

SOCIAL CAPITAL

We aim to nurture transparent and long-term relationships with our stakeholders - whether our shareholders, partners, suppliers, customers, employees and communities. The quality and strength of these relationships determines our ability to execute our strategy and have a positive impact on our communities

OUR KEY INPUTS

-

Rs 2.7m paid in CSR contributions - Collaboration with the Taylor Smith Foundation and other NGOs, and CSR initiatives in Mauritius and Rodrigues

PERFORMANCE HIGHLIGHTS

- Contributed funds to the Taylor Smith Foundation, supporting its actions in the areas of education & youth development, empowerment of women and families, sports, and the protection of the environment

-

Communicated a

monthly Marketing & Communication report to EDITH tenants - Implemented a structured and sustained communication strategy

- Successfully integrated House of Digital Art as a new tenant in La Galerie du Génie in June 2023

-

Provided

project management assistance to 12 tenants for the successful fit-out of their space - Recycled unused annual reports into pencils for distribution to NGOs

2024 PRIORITIES

- Continue contributing to sustainable development, with a focus on economic, social and environmental pillars

-

Education will remain the top priority in our CSR endeavours - Continue lending our support to NGOs and community groups

-

Conduct a

customer satisfaction survey -

Pursue the implementation of the

communication strategy at EDITH -

Collaborate with House of Digital Art to

promote EDITH as a dynamic art, entertainment and dining venue

OUTPUTS AND VALUE CREATED

- The Mauritian Wildlife Foundation (projects at Ile aux Aigrettes in Mauritius, and Anse Quitor in Rodrigues)

- Caritas Ile Maurice (Boutique Solidaire in Flacq, Mauritius)

- Action for Integral Human Development (“Skills for Life” project in schools in Mauritius & Rodrigues)

- Shreeji Education Programme (educational support to empower women and children)

- Anfen (cookery School)

- We-Recycle (specialising in the collection of plastic bottles & cans for recycling, and raising awareness in schools)

Strategic objectives

Operational excellence

Customer service and retention

Sustainability

Maximise shareholder value

Employee engagement

HUMAN CAPITAL

We are dedicated to developing the skills and capabilities of our people, and foster a diverse and inclusive work environment. Our aim is to build highperforming and engaged teams who deliver exceptional customer experiences

OUR KEY INPUTS

-

46 employees -

Rs 1m invested in staff training - Efforts to build a diverse workforce in terms of gender, background, culture and experience

- Training and development opportunities

- Off-site teambuilding activities

PERFORMANCE HIGHLIGHTS

-

Achieved an

81.4% satisfaction score on employee engagement (conducted in October 2023) -

Completed

236 hrs of training - Implemented interdepartmental Service Level Agreements (SLAs) to improve process efficiencies

-

Carried out

Leadership Programme for the Management Team in November 2022 - Developed an induction pack to facilitate the onboarding of new tenants

-

Created a

business continuity plan

2024 PRIORITIES

-

Pursue training & development with a

focus on soft skills : coordination, communication and problem solving -

Review and

reengineer business processes to increase engagement levels and productivity - Develop Competency Framework for all positions at Lavastone Properties

-

Aim for a

staff turnover rate of below 10% -

Update

business continuity plan according to changes in roles and structures

OUTPUTS AND VALUE CREATED

-

32% women | 68% men employed -

33.3% Staff turnover (15 departures over an average of 45 staff during the year, particularly in the operational team) -

100% of employees have participated inat least 1 workshop

Strategic objectives

Operational excellence

Customer service and retention

Sustainability

Maximise shareholder value

Employee engagement

MANAGING DIRECTOR’S

MESSAGE

Dear Stakeholders,

I am delighted to present Lavastone Properties’ ESG abridged Report, which reflects our commitment to sustainable development. This evolution is not merely altruistic; it is, in fact, intricately tied to our long-term business success, a healthier planet and a more equitable society. To better understand, measure and communicate our environmental, social and governance impacts, we align our initiatives with the Global Reporting Initiative and the Global Real Estate Sustainability Benchmark standards.

At Lavastone Properties, sustainability remains a core value in our approach to commercial property development and leasing. This is why as the Managing Director of the Group, it is my responsibility to steer our business practices towards this purpose. Our Sustainability Management Committee, which I lead, is pivotal in integrating sustainability into our core strategy. Recognising that sustainability covers a wide range of issues, we have narrowed our focus on the ones that are most material to our value creation and in harmony with our business objectives:

1. Carbon Footprint Reduction: Implementing innovative practices to actively lower our carbon footprint.

2. Energy Efficiency: Integrating advanced solutions for optimising energy use.

3. Water Efficiency: Managing water resources responsibly to minimise waste.

4. Sustainable Procurement: Ensuring responsible sourcing within our supply chain.

5. Recycling Initiatives: Enhancing waste reduction and recycling processes.

6. Employee Welfare: Prioritising the wellbeing and development of our team.

These priorities reflect our holistic approach to sustainability, which balances environmental stewardship with social responsibility and business resilience.

Thank you for your support on this journey towards a more sustainable, responsible future in real estate.

Nicolas Vaudin

Managing Director, Lavastone Properties

SUSTAINABILITY HIGHLIGHTS

IN FY 2023

ENVIRONMENT

Implementation of PV EV chargers

Installation of 50 eco-taps

Recycling of annual reports into 2,000 pencils

LEED Certification obtained at EDITH

SOCIAL

Delivered sustainability training to employees

Achieved employee engagement score of

more than 80%

GOVERNANCE

Implementation of PV EV chargers

Installation of 50 eco-taps

Recycling of annual reports into 2,000 pencils

LEED Certification obtained at EDITH

Our ESG framework

Lavastone Properties has established its Environmental, Social and Governance (ESG) framework in accordance with the components of the Global Reporting Initiative (GRI) and the Global Real Estate Sustainability Benchmark (GRESB). Our practices support our vision and risk appetite statement, while contributing to the UN Sustainable Development Goals (SDGs).

To ensure we deliver on our commitments effectively, we have developed an appropriate oversight structure, and a culture of ownership and accountability. Our Board of Directors is ultimately accountable for our ESG strategy and supports initiatives through the delegation of its ESG risk management to the Risk Management and Audit Committee (RMAC).

We have also created a Sustainability Management Committee (SMC), chaired by the Managing Director and consisting of ESG champions for each area of focus. The SMC reports all ESG-related matters to the RMAC on a quarterly basis.

Our strategy and priority areas

At Lavastone Properties, sustainability is not considered an optional add-on, but an intrinsic part of our core business, and central to our values and vision for the future. This vision guides us to grow in an environmentally responsible manner and contribute to the social well being of our employees and the community, all while delivering optimum value to our shareholders. To advance our sustainability goals, we recognise the importance of close collaboration and collective actions with various stakeholders, such as environmental organisations, government agencies, non-profit organisations, and recycling partners.

Our key priority areas for sustainable development and inclusiveness for the next years, as identified by the Board of Directors, are centred on:

Carbon footprint

Water efficiency

Recycling and waste management

Energy efficiency

Sustainable procurement

Employee welfare (employee engagement & performance)

Our ESG performance

I. ENVIRONMENT

Our commitment to building and operating sustainably, embracing clean energy, managing our waste responsibly and encouraging electric mobility is aimed at building a portfolio of energy-efficient and eco-friendly properties, with a reduced environmental footprint.

Our Carbon Footprint

Partners: WillChange

Following our carbon footprint assessment conducted in FY 2021, we found that the examination of our Scope 3 emissions was somewhat limited and required a deeper dive. We embarked on a proactive journey with WillChange drawing on their experience in business development and expertise in the carbon economy to gain a more comprehensive understanding of our indirect emissions This partnership is not only enabling us to calculate our carbon footprint, anchored in the ‘Bilan Carbone’ framework, but it also guides us towards building autonomy and excellence in this area through targeted employee training.

Recycling and waste management

(i) Recycled annual reports partners: Morivert

Our partnership with Morivert, an organisation dedicated to environmental sustainability, enabled the manufacturing of 2,000 branded pencils from recycled annual reports, resulting in a substantial reduction of 36 kilograms of paper waste. These pencils were thoughtfully distributed to our employees, loyal clients, and local schools.

(ii) E-waste partners: BEM Recycling

This partnership highlights our commitment to reducing e-waste and adhering to ethical and responsible disposal practices of:

• Non-reusable batteries

• Electronic waste (mouse, keyboards etc)

(iii) Waste management partners: GREEN and BiobiN

The use of ‘MOLOK’ bins provided by GREEN, coupled with their recycling facilities, has enabled us to improve our waste collection practices, while also reducing the impact of the transportation of waste materials. We made strides in managing our organic and wet waste, thanks to a partnership with BiobiN, an innovative and patented on-site containment and processing system that manages food and organic waste that would otherwise end up in landfill

Energy and water efficiency

(iv) Electric mobility partners: Central Electricity Board (CEB) and GREEN YELLOW

In pursuit of the transition towards cleaner energy sources, we have partnered with specialised companies to implement Photovoltaic (PV) Electric Vehicle (EV) chargers. We have taken a transformative step by equipping the roof of one of our parking facilities with photovoltaic panels, which boast an installed capacity of 47 kWp. This collaboration not only benefits Lavastone Properties, but also aligns with national goals for a more sustainable energy mix.

(v) Eco-taps partners: Fralain

We initiated the installation of 50 e co-taps at the Edith and Cascades buildings, which represent a significant advancement in water conservation technology. These innovative fixtures have replaced conventional taps with automatic sensors, designed to reduce the flow of water to a mere 1.33 litres per minute, compared to the previous 5 litres per minute.

LEED Certification

(vi) Partners: Leadership in Energy and Environmental Design (LEED)

We adhere to specific environmental certifications and standards in line with LEED, at both the design and operations stages. As a result of our diligent efforts, EDITH has received the LEED Gold certification, which recognises exemplary leadership in sustainable building practices. We aim to build on this achievement and further improve the efficiency of our operations by working towards the platinum status.

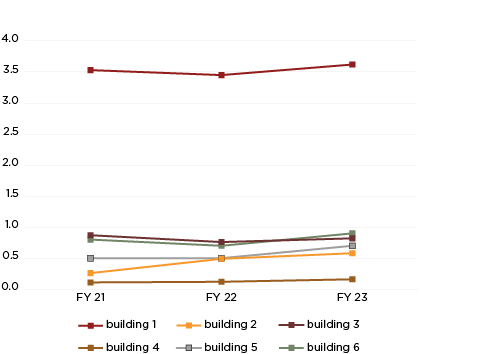

In our endeavours to have LEED-certified buildings, we undertook a comprehensive evaluation of the factors influencing our energy consumption, focusing on the monthly average energy usage per Gross Leasable Area (GLA) within our office portfolio and the energy use of the various asset types.

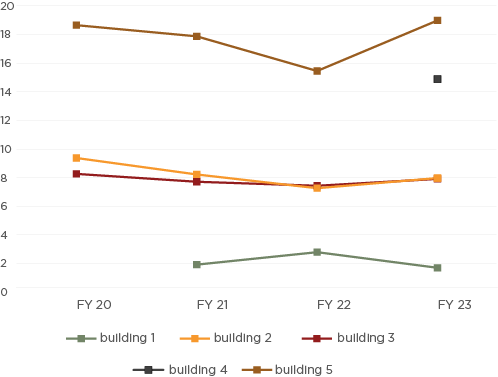

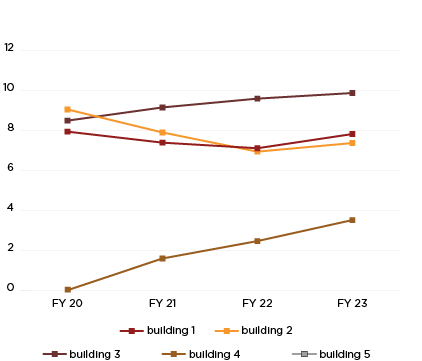

Energy use by GLA (kWh/m²)

Total Grid Energy Use (KWh)

We observed a stable trend in water usage, and further positive changes are anticipated following the implementation of eco-taps. This initiative is expected to yield notable reductions in water consumption, particularly at Les Cascades and St Georges buildings.

Water consumption per GLA (m3/m2)

Average Monthly Energy consumption by GLA (kWh/m²)

II. SOCIAL

Our social commitment is reflected in our investments in our employees, our tenants and customers, and our community-driven initiatives.

Employees

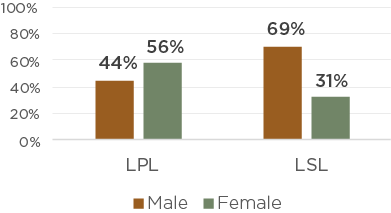

(a) Employee ’ profiles at Lavastone Properties (LPL) and Lavastone Services (LSL)

Employee profile by gender

We recognise that a positive and fair working environment is critical to attract and retain talent. Our employee programme was developed with this in mind, and aims to enhance performance, learning, career development and wellbeing.

(b) Talent Management and Employee Performance & Engagement

in a bid to better manage our talent, we have implemented robust recruitment procedures, timely

induction programmes, and adequate learning and development opportunities, working to create a pipeline of

future leaders through succession planning. Employee engagement and recognition are achieved through regular

communication and involvement, as well as our performance management system

Engagement survey results

2021

84.8%

2022

85%

2023

81.4%

To enhance our commitment to our employees and strengthen the team cohesion, we engage frequently with our people through:

• Sessions on the company’s values and expected behaviours

• Quarterly town hall meetings

• Monthly presentations of our employees on social media

Performance management

Our performance management system was introduced and developed to provide an incentive scheme based on Group results, individual and team performances. The performance management process consists of three key steps:

• Setting Key Performance Objectives

• Mid-year review

• Final assessment

In order to boost the performance of various departments and enhance the efficiency across and between the different teams, specific Service Level Agreements and performance indicators have been established since July 2023 and are evaluated on a monthly basis. This enables each department and each individual to track their progress towards the defined targets and objectives.

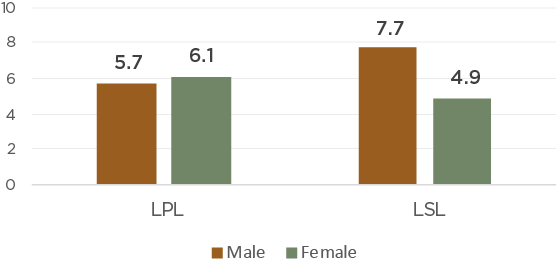

(c) Learning & Development

Learning and Development opportunities are provided to Lavastone Properties’ employees through appropriate induction and training. Adequate training enables the acquisition and enhancement of skills, knowledge and expertise and supports the Company’s leadership and succession planning. Our training programmes have covered topics such as Management and Compliance, Health & Safety, Cybersecurity and Sustainability.

Average training hours per employee

Community

Lavastone Properties is committed to improving customer service and operational excellence to achieve its vision to be the preferred partner for commercial real estate solutions by delivering superior value.

We engage with the community and strive to fulfil our social responsibility by sponsoring CSR projects through the Taylor Smith Foundation. The mission of the Foundation is to contribute to sustainable development, with a focus on economic, social and environmental pillars. It also uses the United Nations’ Sustainable Development Goals (SDGs) as guiding principles, with education remaining a top priority.

In FY 2023, our contribution was used to finance several projects through different NGOs, such as:

• Mauritian Wildlife Foundation (Projects at L’Ile Aux Aigrette,

Mauritius & Anse Quitor, Rodrigues).

• Caritas Ile Maurice (Boutique Solidaire in Flacq, Mauritius)

• Action For Integral Human Development (“Skills for Life” project

in schools, Mauritius & Rodrigues)

• Shreeji Education Program (Educational support to children &

women’s empowerment )

• Anfen (Cookery School)

• We-Recycle (Specialises in the collection of plastic bottles & cans

for recycling + Awareness sessions in schools)

Amount

contributed:

Spotlight on: The Fairy Tree Project

This participatory art project was imagined by THE THIRD DOT and inspired by the exhibition ‘Porte-Bonheurs’ at Le Bon Marché in Paris. The Fairy Tree project involved the installation of handcrafted fabric icons hanging on countless vines at La Cour du Génie at EDITH. Local icons, such as the well known Mauritian artist Malcolm de Chazal, inspired the butterfly, dodo, parrot and hibiscus designs.

The icons were sewn by six women from vulnerable communities in the region of La Gaulette, and supported by the association ‘Les Anges du Soleil’ whose mission is to uplift the precarious cities of Tamarin and Black River and help families escape the pattern of generational poverty through education and support.

Sewers in the region of La Gaulette were sponsored for an amount

of Rs 91.5k.

Amount

sponsored:

III. GOVERNANCE

Corporate Governance enhances accountability, transparency and ethics. It is increasingly viewed as valuable by investors as it establishes trust and confidence among stakeholders, and enhances a company’s long-term performance. As a listed company on the Stock Exchange of Mauritius and a responsible citizen of Mauritius, Lavastone Properties has not only adopted the practices set out in the National Code of Corporate Governance, but we are also strongly committed to maintaining the highest level of integrity in our business practices to achieve sustainable development. The Board of Directors ultimately retains the accountability and responsibility to implement the Corporate Governance Framework, which also incorporates the Risk Management Framework, the Business Continuity Management Framework (BCM), and relevant policies and procedures.

Key figures

Board independence:

38%

Women on Board:

25%

Women in Management:

46%

Business Continuity Management Framework (BCMF)

Our BCM framework is based on ISO 22301, and includes a Business Continuity policy established in 2021, a BCM champion, as well as the business continuity plan and objectives. The purpose of the programme is to:

• Minimise the risk of disruptive incidents through collaboration;

• Establish appropriate business continuity targets and solutions for prioritis ed activities;

• Embed business continuity across Lavastone Properties.

Policies and Procedures

As part of its Risk Management process, Lavastone Properties has established several policies and procedures to prevent and mitigate key operational, regulatory, technological and financial risks:

a. Code of Conduct / Code of Ethics

b. Risk Management policy

c. Business Continuity Management policy

d. AML/CFT policy

e. Information Security policy

f. Privacy policy

g. Whistleblowing policy

h. Conflict of Interest policy

i. Fraud, Corruption and anti-bribery policy

CASE STUDY:

HOTEL AT MOUROUK, RODRIGUES

A KITESURFING AND WINDSURFING PARADISE

AT A GLANCE

• 3-star hotel with 2 restaurants, a Boathouse and Kite Club, 1 beachfront bar, 1 pool, kids club, a conference room

• A focus on health and wellness, with an outdoor health track, group fitness and yoga sessions, rental bikes, seaside massages

• 66 rooms and 2 villas to equate 71 rooms in total

• Located at Mourouk, ranked in the top 10 kitesurfing destinations in the world

• Carbon-Neutral Stay available

• One booking = One coral planted

• Customised packages to explore Rodrigues

Background and context

In 2018, we were approached by Trimetys Hotels for an investment opportunity in Rodrigues. At the time, Lavastone Properties held a satisfactory portfolio of yielding properties, including a mix of office and industrial buildings, and had recently forayed into the hospitality segment with the Sunrise Attitude Hotel. Trimetys, for its part, was intent on expanding its footprint in Rodrigues, building on the success and experience garnered from operating Le Tekoma Boutique Hotel on the island. They turned their sights to Mourouk Ebony Hotel, a 3-star resort that has been part of the landscape of Rodrigues since 1994.

This opportunity piqued our interest for many reasons. Firstly, hospitality was not an unknown territory to Lavastone Properties. Several members of Lavastone Properties’ leadership and management team have extensive experience in the sector and were in a position to add value to the conceptualisation and masterplan of the project. Additionally, Trimetys Hotels is an established hotel operator in Rodrigues, with ample local knowledge, strong relationships with the community, and best practices specific to the island. These factors are crucial in navigating the complexities associated with running a hotel in Rodrigues.

After carefully evaluating the opportunity, we proposed a plan to provide a higher standard of service and accommodation to guests, aimed at maximising the yielding potential of the property: an expansion of the hotel from 35 to 66 rooms with the possibility to extend this to 85 rooms, and a series of renovations to upgrade some of the hotel’s facilities, including the common areas, core infrastructure, service levels, and health and safety aspects.

In February 2019, Lavastone Properties finalised the acquisition of Compagnie Valome Ltée (CVL), which owned the premises of Mourouk Ebony Hotel, covering an area of 35,326 m2. CVL entered into a triple net lease agreement with Mourouk Ebony Management Ltd, a subsidiary of Trimetys Hotels, to lease the hotel property until June 2031. In early 2020, we obtained the first permits to renovate parts of the hotel, and we prepared to close the hotel doors between January and November 2020 to carry out our expansion and renovation plans. Then came the pandemic.

THE CHALLENGES WE FACED

Accessibility

Rodrigues’ appeal lies in its remoteness, seclusion and pristine beaches, beckoning travellers in quest of the ultimate Robinson Crusoe escapade. However, building and operating a hotel in an isolated location presents a host of logistical challenges for real estate developers and hotel operators: limited transportation infrastructure, and infrequent air and sea transport hinder the ability to procure essential supplies such as food, construction materials, equipment and other resources to the island. In parallel, limited access to important utilities, such as electricity, water or telecommunications, often requires hotels to invest in backup systems and to excel at planning, budgeting, project management and supply chain management.

Financial viability

Building and operating a hotel is inherently a complex and multifaceted endeavour, as several regulations and

standards must be complied with, a wide range of stakeholders must be managed, several unforeseen situations

and weather conditions can arise, and staffing challenges increasingly threaten the smooth running of hotels.

The remoteness of Rodrigues introduces additional financial pressures, such as the risk of longer lead times,

which could translate into revenue losses and affect the return on investment.

Adding another layer of complexity, the pandemic hit the world in March 2020, causing international and domestic

travel to come to a brutal halt. Given the travel constraints, Trimetys’ and Lavastone Properties’ teams were unable to

visit the site and liaise with the stakeholders. In fact, the site was handed over through the contractor via video call.

In May 2020, travel between Rodrigues and Mauritius resumed, leading us to believe that the difficulties were

behind us. In October 2021, however, Rodrigues recorded its first Covid-19 case, prompting the island to close its

borders until March 2022, and further delaying the opening of the hotel.

Environmental and cultural considerations

Rodrigues’ untouched beaches and unique ecosystems must be preserved at all costs to ensure the sustainability of the island. Understanding and respecting the local culture is equally crucial in promoting positive interactions with the community. Hotel operators must take into account the impact of their operations on their surroundings, and ensure that their presence benefits the region.

OUR RESPONSE

Accessibility

The limited number of accommodations in Rodrigues prompted the decision to redevelop the hotel, which improves both the island’s visibility and the hotel’s accessibility to new travellers. In light of the challenges in procuring essential resources, energy and water in particular, we have installed a full-power backup system to ensure uninterrupted operations. Additionally, we built a desalination plant to overcome water scarcity, supply enough water for the resort’s operations, and also offer a sustainable solution for reliable water on the island.

Financial viability

A strong and distinct brand identity

The full renovation of the hotel called for a new brand identity in line with its modernity-meets-retro vibe.

Mourouk Ebony Hotel became PLAY Mourouk, aptly named as a playground for kitesurfers and windsurfers on

one of the world’s most iconic kitesurfing beaches. In 2019, plans had already been made for the extension of

the hotel to 66 rooms, a new bar with a DJ booth, and a panoramic restaurant. In 2020, the challenges related to

the pandemic prompted a deeper reflection on how to maximise the hotel’s revenue potential. We increased the

number of rooms to 71 instead of the original 66, in a bid to improve the earning potential of the operator and

consequently the profitability of the project for CVL.

Selecting the right partners

Trimetys Group has extensive experience operating in the hospitality and real estate industry. Today, it operates and

manages Be Cosy Apart’Hotel and Sakoa Boutik Hotel in Trou aux Biches, Mauritius, and Le Tekoma Boutique Hotel,

which has earned a reputation as one of the most coveted hotels in Rodrigues. Each one of these hotels is rooted

in a strong concept and unique identity, and PLAY Mourouk is no different. Additionally, Trimetys is well-regarded

among the local workforce, a factor that could help to attract and retain talents seeking an employer with a proven

and stable track record.

In October 2023, Constance Hotels Services Ltd announced the acquisition of 60% of Ebony Management Ltd for

the management and operation of PLAY Mourouk. Constance’s expertise in operating C Resorts, which shares

similarities with PLAY Mourouk in terms of market segment and guest experience, is a valuable asset that will

serve to enhance operational efficiency, elevate service standards, and promote both Rodrigues and the hotel

more effectively. As of January 2024, the hotel will be branded and operated in line with the C Resorts concept.

Environmental and cultural considerations

Sustainability at heart

The preservation of the unique environment and culture of Rodrigues are at the heart of Lavastone Properties.

An alignment in environmental and societal values between Lavastone Properties, Trimetys and Constance has

given rise to a value proposition that weaves responsible tourism into every aspect of the guest journey: reused

plastic bottles and old kite surfs make up the interiors of the hotel; a partnership with Bluer Ocean Project,

which aims to protect the lagoon and coral reef in Rodrigues; the option to have a carbon-neutral stay and to

embrace initiatives such as desalinated water production to reduce water stress; a waste water treatment plant

to treat all effluents for reissue as irrigation water; employment of 100% employees from Rodrigues; favouring

locally-made, locally-sourced and eco-friendly products; and a push to explore the island and promote awareness

about its unique environmental and cultural aspects. Following the opening of the hotel, we are considering

further initiatives, such as photovoltaic farms, to further reduce our carbon footprint and participate in the

socioeconomic development of the island.

RODRIGUES

AS YOUR

PLAYGROUND

“PLAY Mourouk isn’t just a stay – it’s a joyride, a life-highlight reel, a mixtape of unforgettable moments. We’ve stirred the retro surf magic into the Rodrigues authenticity, cooking up an atmosphere that’s classic, cool, and captivating. Besides catching waves, we also ride the green wave of sustainability.”